SECURITIES AND EXCHANGE COMMISSION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨ Check the appropriate box:

|

| | |

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

ELI LILLY AND COMPANY

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

| ELI LILLY AND COMPANY |

| (Name of Registrant as Specified In Its Charter) |

|

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| | | | |

| Payment of Filing Fee (Check the appropriate box): |

| | | | |

| x | | No fee required. |

| | |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | | | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| ¨ | | Fee paid previously with preliminary materials. |

| | | | |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | | | |

| | (1) | | Amount Previously Paid: |

| | | | | |

| | (2) | | Form, Schedule or Registration Statement No.: |

|

| |

| SEC 1913 (11-01) | | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

2012Note: Due to a filing error, we are refiling the Definitive Proxy Statement for our 2013 annual meeting of shareholders to clarify that it is the Definitive Proxy Statement and not Additional Soliciting Materials. This filing does not update, amend or restate items in the proxy statement for the 2013 annual meeting of shareholders, which continue to speak as of the date of original filing, March 25, 2013.

2013 Annual Meeting and Proxy Statement You are cordially invited to attend our annual meeting of shareholders on Monday,

April 16, 2012.May 6, 2013.

The notice of meeting and proxy statement that follow describe the business we will consider at the meeting. Your vote is very important. I urge you to vote by mail, by telephone, or on the Internet to be certain your shares are represented at the meeting, even if you plan to attend.

I look forward to seeing you at the meeting.

John C. Lechleiter, Ph.D.

Chairman, President, and Chief Executive Officer Important notice regarding the availability of proxy materials for the shareholder meeting to be held April 16, 2012: May 6, 2013:

The annual report and proxy statement are available at http://www.lilly.com/pdf/lillyar2011.pdflillyar2012.pdfNotice of Annual Meeting of ShareholdersApril 16, 2012

May 6, 2013

The annual meeting of shareholders of Eli Lilly and Company will be held at the Lilly Center Auditorium, Lilly Corporate Center, Indianapolis, Indiana, 46285 on Monday, April 16, 2012,May 6, 2013, at 11:00 a.m. EDT for the following purposes:

to elect fourfive directors of the company to serve three-year terms

to ratify the appointment by the audit committee of Ernst & Young LLP as principal independent auditor for the year 2012

2013to approve, by non-binding vote, compensation paid to the company’s named executive officers

to approve amendments toreapprove the articlesmaterial terms of incorporation to providethe performance goals for annual election of all directors

the 2002 Lilly Stock Plan.to approve amendments to the articles of incorporation to eliminate all supermajority voting requirements

to consider shareholder proposals on establishing a majority vote committee and transparency in animal research.

Shareholders of record at the close of business on February 15, 2012,March 1, 2013, will be entitled to vote at the meeting and at any adjournment of the meeting.

Attendance at the meeting will be limited to shareholders, those holding proxies from shareholders, and invited guests from the media and financial community. A page at the back of this report contains an admission ticket. If you plan to attend the meeting, please bring this ticket with you.

This combined proxy statement and annual report to shareholders is being posted online and mailed on or about March

5, 2012.25, 2013.

By order of the board of directors,

1

Proxy Statement Overview

Annual Meeting of Shareholders

The annual meeting of shareholders will be held at 11:00 a.m. EDT on Monday,

April 16, 2012May 6, 2013 at:

The Lilly Center Auditorium

Indianapolis, Indiana 46285

The board of directors of Eli Lilly and Company,

"we," "Lilly," or "the company," is soliciting proxies to be voted at the annual meeting and at any adjournment of the annual meeting. The record date for voting is

February 15, 2012.March 1, 2013.

Shareholders will vote on the following items at the annual meeting:

| | | | | | | | | | | | | | |

Agenda Item | | | | | | | | | | | Management

recommendation | | Vote required to

pass |

Item 1 | | Elect the following nominees for director to serve a three-year term that will expire in 2015: | | Vote FOR all | | Majority of

votes cast |

Name and principal occupation | | Joined the board | | | Age | | | Public boards | | | | |

| | | | | |

Katherine Baicker, Ph.D. Professor of Health Economics, Harvard University | | 2011 | | | 40 | | | — | | Vote FOR | | |

| | | | | |

J. Erik Fyrwald President, Ecolab Inc. | | 2005 | | | 52 | | | — | | Vote FOR | | |

| | | | | |

Ellen R. Marram President, The Barnegat Group LLC | | 2002 | | | 65 | | | Ford Motor Company

The New York Times

Company | | Vote FOR | | |

| | | | | |

Douglas R. Oberhelman Chairman and Chief Executive Officer, Caterpillar Inc. | | 2008 | | | 59 | | | Caterpillar Inc. | | Vote FOR | | |

Item 2 | | Ratify the appointment of Ernst & Young as the company’s principal independent auditor. | | Vote FOR | | Majority of

votes cast |

Item 3 | | Approve, by non-binding vote, compensation paid to the company’s named executive officers. | | Vote FOR | | Majority of

votes cast |

Item 4 | | Approve amendments to the articles of incorporation to provide for annual election of all directors. | | Vote FOR | | 80% of out-

standing shares |

Item 5 | | Approve amendments to the articles of incorporation to eliminate all supermajority voting requirements. | | Vote FOR | | 80% of out-

standing shares |

Item 6 | | Consider a shareholder proposal on establishing a majority vote committee. | | Vote AGAINST | | Majority of

votes cast |

Item 7 | | Consider a shareholder proposal on transparency in animal research. | | Vote AGAINST | | Majority of

votes cast |

|

| | | | | | |

Agenda

Item |

|

|

|

| Management

recommendation | Vote required to pass |

| Item 1 | Elect the following nominees for director to serve a three-year term that will expire in 2016: | Vote FOR all | Majority of

votes cast |

| Name and principal occupation | Joined the board | Age | Public boards |

|

|

|

|

|

|

|

|

| Ralph Alvarez

| 2009 | 57 | Lowe's Companies, Inc.; Dunkin' Brands Group, Inc. | Vote FOR |

|

| Executive Chairman,

Skylark Co., Ltd. |

|

|

|

|

|

|

|

| Sir Winfried Bischoff

| 2000 | 71 | The McGraw-Hill Companies, Inc. | Vote FOR |

|

| Chairman, Lloyds Banking Group plc |

|

|

|

|

|

|

|

| R. David Hoover

| 2009 | 67 | Ball Corporation;

Energizer Holdings, Inc.; Steelcase, Inc. | Vote FOR |

|

| Chairman, Ball Corporation |

|

|

|

|

|

|

|

|

| Franklyn G. Prendergast, M.D., Ph.D.

| 1995 | 68 | __ | Vote FOR |

|

| Edmond and Marion Guggenheim Professor of Biochemistry and Molecular Biology and Professor of Molecular Pharmacology and Experimental Therapeutics, Mayo Medical School; and Director Emeritus, Mayo Clinic Center for Individualized Medicine |

|

|

|

|

|

|

|

|

| Kathi P. Seifert | 1995 | 63 | Supervalu Inc.; Revlon Consumer Products Corporation; Lexmark International, Inc. | Vote FOR |

|

| Retired Executive Vice President, Kimberly-Clark Corporation |

|

| Item 2 | Ratify the appointment of Ernst & Young LLP as the company’s principal independent auditor. | Vote FOR | Majority of

votes cast |

| Item 3 | Approve, by non-binding vote, compensation paid to the company’s named executive officers. | Vote FOR | Majority of

votes cast |

| Item 4 | Reapprove the material terms of the performance goals for the 2002 Lilly Stock Plan. | Vote FOR | Majority of

votes cast |

The company’s board is comprised of our chairman, president, and CEO, John Lechleiter, Ph.D.

, and 13 independent directors. Their biographies and qualifications can be found under

“Director Biographies”“Director Biographies” below.

Committees of the board of directors

” below.

Our independent directors receive cash compensation in the form of an annual retainer ($100,000), with additional annual amounts for the lead director ($30,000), committee chairs ($12,000 to $18,000, depending on the committee), and directors who serve on the audit committee or the science and technology committee ($3,000). In addition, each independent director receives $145,000 in shares of company stock each year, payable after service on the board has ended. Additional information about director compensation can be found under

“Director Compensation”“Director Compensation” below.

2

Contacting the board of directors You may send written communications to one or more members of the board, addressed to:

Indianapolis, Indiana 46285

All such communications (from shareholders or other interested parties) will be forwarded to the relevant

director(s), except for solicitations or other matters unrelated to the company.

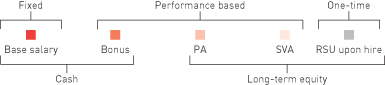

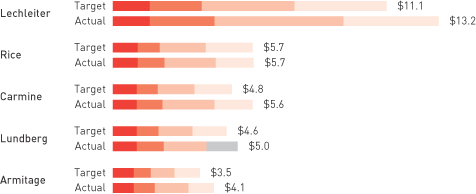

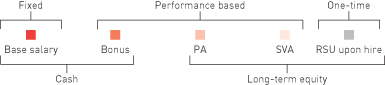

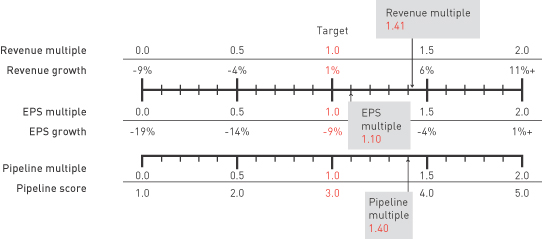

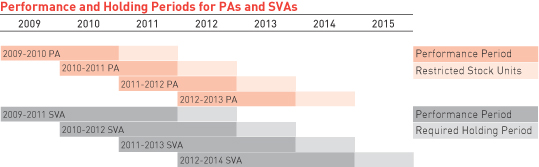

Our compensation philosophy is designed to attract and retain highly-talented individuals and motivate them to create long-term shareholder value by achieving top-tier corporate performance while embracing the company’s values of integrity, excellence, and respect for people. Our programs seek to:

closely link compensation with company performance and individual performance

reflectprovide compensation consistent with the level of job responsibility and the market for pharmaceutical talent

be efficient and egalitarian

appropriately mitigate risk.

riskconsider shareholder input.

” section of this proxy statement.

3

Board of Directors

| | | | | |

| | | | | | |

Katherine

Baicker,

Ph.D. | | Michael L.

Eskew | Katherine Baicker, Ph.D. | Sir Winfried

Bischoff | | Alfred G.

Gilman, M.D., Ph.D. | | Karen N.

Horn,

Ph.D. | | Franklyn G.

Prendergast,

M.D., Ph.D. | | J. Erik

Fyrwald |

Professor

of Health

Economics,

Department of

Health Policy and

Management,

Harvard

University School

of Public Health;

and Research

Associate,

National Bureau

of Economic

Research

| | Former Chairman

and Chief

Executive Officer,

United Parcel

Service, Inc.

| | Chairman,

Lloyds Banking

Group plc | | Chief Scientific

Officer, Cancer

Prevention and

Research

Institute of Texas | | Retired

President,

Private Client

Services, and

Managing

Director,

Marsh, Inc.

| | Edmond and Marion

Guggenheim

Professor of

Biochemistry and

Molecular Biology

and Professor

of Molecular

Pharmacology

and Experimental

Therapeutics, Mayo

Medical School;

and Director, Mayo

Clinic Center for

Individualized

Medicine

| | President,

Ecolab Inc. |

Director

since 2011

| | Director

since 2008 | | Director

since 2000

| | Director

since 1995 | | Director

since 1987

| | Director

since 1995

| | Director

since 2005 |

Board

committee:

public policy

and compliance

| | Board

committees:

audit [chair];

compensation

| | Board

committees:

directors and

corporate

governance;

finance

[chair]

| | Board

committees:

public policy

and compliance;

science

and technology

[chair]

| | Board

committees:

compensation

[chair];

directors and

corporate

governance

| | Board

committees:

public policy

and compliance;

science and

technology

| | Board

committees:

public

policy and

compliance;

science

and technology

R. David Hoover |

4

| | | | | | | | | | | | |

R. David

Hoover

| | John C.

Lechleiter,

Ph.D.

| | Douglas R.

Oberhelman

| | Ellen R.

Marram

| | Martin S.

Feldstein,

Ph.D.

| | Kathi P.

Seifert

| | Ralph

Alvarez

|

Chairman,

Ball Corporation

| | Chairman,

President, and

Chief Executive

Officer

| | Chairman and

Chief Executive

Officer,

Caterpillar Inc.

| | President,

The Barnegat

Group LLC

| | George F. Baker

Professor of

Economics,

Harvard

University

| | Retired Executive

Vice President,

Kimberly-Clark

Corporation

| | Retired President

and Chief

Operating Officer,

McDonald’s

Corporation

|

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Director

since 2009

| | Director

since 2005

| | Director

since 2008

| | Director

since 2002

| | Director

since 2002

| | Director

since 1995

| | Director

since 2009

|

Board

committees:

audit;

compensation

| | Board

committees:

none

| | Board

committees:

audit; finance

| | Board

committees:

compensation;

directors

and corporate

governance

[chair]

| | Board

committees:

audit; finance;

public policy

and compliance

[chair]

| | Board

committees:

audit;

compensation

| | Board

committees:

finance; public

policy and

compliance;

science and

technology

|

5

Each of our directors is elected to serve until his or her successor is duly elected and qualified. If a nominee is unavailable for election, proxy holders may vote for another nominee proposed by the board of directors or, as an alternative, the board of directors may reduce the number of directors to be elected at the annual meeting. Each nominee has agreed to serve on the board of directors if elected.

Set forth below is the information as of March 13, 2013, regarding the nominees for election, which has been confirmed by each of them for inclusion in this proxy statement. Under the heading "Qualifications," we list the specific experiences, qualifications, attributes, or skills that led to the conclusion that each director or director nominee should serve as one of our directors in light of our business and structure.

No family relationship exists among any of our director nominees or executive officers. To the best of our knowledge, there are no pending material legal proceedings to which any of our directors or nominees for director, or any of their associates, is a party adverse to us or any of our affiliates, or has a material interest adverse to us or any of our affiliates. Additionally, to the best of our knowledge, there have been no events under any bankruptcy act, no criminal proceedings and no

judgments, sanctions, or injunctions that are material to the evaluation of the ability or integrity of any of our directors or nominees for director during the past

10 years.

The following five directors’ terms will expire at this year’s annual meeting.

Dr. Feldstein will retire from the board at the end of his current term. Each of the other directors in this class has been nominated and is standing for election to serve a term that will expire in 2015. See

“Item“Item 1. Election of Directors”Directors” below for more information.

Ralph Alvarez,Age 57, Director since 2009 Executive Chairman, Skylark Co., Ltd.

Mr. Alvarez is executive chairman of Skylark Co., Ltd., a leading restaurant operator in Japan, a position he has held since January 2013. Previously, Mr. Alvarez served as president and chief operating officer of McDonald's Corporation from August 2006 until his retirement in December 2009. He also served as president of McDonald's North America, with responsibility for all the McDonald's restaurants in the U.S. and Canada. Prior to that, he was president of McDonald's USA.

Mr. Alvarez joined McDonald's in 1994 and held a variety of leadership roles throughout his career, including chief operations officer and president of the central division, both with McDonald's USA and president of McDonald's Mexico. Prior to joining McDonald's, he held leadership positions at Burger King Corporation and Wendy's International, Inc. Mr. Alvarez serves on the board of directors of Skylark Co., Ltd., Lowe's

|

| | | | | | |

Katherine Baicker,John C. Lechleiter, Ph.D. | Douglas R. Oberhelman | Age 40 | | Director since 2011 |

Professor of Health Economics at the Harvard University School of Public Health, Department of Health Policy and Management; and Research Associate at the National Bureau of Economic Research

Dr. Baicker has been a professor of health economics at the Department of Health Policy and Management, School of Public Health, since 2007. From 2005 to 2007, she served as a Senate-confirmed member of the Council of Economic Advisers. From 1998 to 2005, Dr. Baicker was assistant professor and associate professor of economics at Dartmouth College. In 2001 and 2002 she also served as an economist to the Council of Economic Advisers, Executive Office of the President, and in 2003 was a visiting assistant professor at the University of Chicago Harris School of Public Policy. Dr. Baicker is a commissioner of the Medicare Payment Advisory Board and serves on the Panel of Health Advisers to the Congressional Budget Office. She is a member of the editorial boards ofHealth Affairs and theJournal of Health Economics, chair of the board of directors of AcademyHealth, editor of theForum for Health Economics and Policy, and associate editor of theJournal of Economic Perspectives. She is an elected member of the Institute of Medicine. Dr. Baicker has been serving under interim election since December 2011.

Qualifications: Dr. Baicker is a leading researcher in the fields of health economics, public economics, and labor economics. As a valued advisor to numerous health care-related commissions and committees, her expertise in health care policy and health care delivery is recognized by both academia and government.

Board committee: public policy and compliance

|

| | | | |

Martin S. Feldstein, Ph.D. | | Age 72 | | Director since 2002 |

George F. Baker Professor of Economics, Harvard University

Dr. Feldstein is the George F. Baker Professor of Economics at Harvard University and president emeritus of the National Bureau of Economic Research. From 1982 through 1984, he served as chairman of the Council of Economic Advisers and President Ronald Reagan’s chief economic adviser. Dr. Feldstein served as president and chief executive officer of the National Bureau of Economic Research from 1977 to 1982 and 1984 to 2008. In 2009, President Obama appointed him to the President’s Economic Recovery Advisory Board. He is a member of the American Philosophical Society, a corresponding fellow of the British Academy, a fellow of the Econometric Society, and a fellow of the National Association for Business Economics. Dr. Feldstein is a trustee of the Council on Foreign Relations and a member of the Trilateral Commission, the Group of 30, the American Academy of Arts and Sciences, and the Council of Academic Advisors of the American Enterprise Institute, as well as past president of the American Economic Association. He previously served on the boards of American International Group, Inc., TRW, Phoenix Life Insurance, and HCA Inc.

Qualifications: Dr. Feldstein is a renowned economist, academic, and adviser to U.S. presidents of both political parties. He has deep economic and public policy expertise, financial acumen, and a global perspective. His background as an academic brings a diversity of experience and perspective to the board’s deliberations. He has also served on the boards of several major public companies.

Board committees: audit; finance; public policy and compliance (chair)

|

6

| | | | |

J. Erik Fyrwald | | Age 52 | | Director since 2005 |

President of Ecolab Inc.

J. Erik Fyrwald is president of Ecolab Inc. Prior to the merger of Ecolab and Nalco Company in December 2011, Mr. Fyrwald was chairman and chief executive officer of Nalco from 2008 to 2011. He joined Nalco following a 27-year career at DuPont. From 2003 to 2008, Mr. Fyrwald served as group vice president of the agriculture and nutrition division at DuPont. From 2000 until 2003, he was vice president and general manager of DuPont’s nutrition and health business. At DuPont, he held a broad variety of assignments in a number of divisions covering many industries. He has worked in several locations throughout North America and Asia. Mr. Fyrwald serves as a director of the Society of Chemical Industry, the American Chemistry Council, and the Chicago Public Education Fund, and is a trustee of the Field Museum of Chicago.

Qualifications: Mr. Fyrwald has a strong record of operational and strategy leadership in two complex worldwide businesses with a focus on technology and innovation. An engineer by training, he has extensive senior executive experience at DuPont, a multinational chemical company, where he led the agriculture and nutrition division, which used chemical and biotechnology solutions to enhance plant health. He served for three years as chairman of the board and CEO of Nalco, a global technology-based water products and services company.

Board committees: public policy and compliance; science and technology

|

| | | | |

| Ellen R. Marram | Sir Winfried Bischoff | Age 65William G. Kaelin, Jr., M.D. | Kathi P. Seifert | Director since 2002 |

President, The Barnegat Group LLC

Ms. Marram will serve as the board’s lead director beginning April 2012. Ms. Marram is the president of The Barnegat Group LLC, a firm that provides business advisory services. She was a managing director at North Castle Partners, LLC from 2000 to 2005 and served as an advisor to the firm from 2006 to 2010. From 1993 to 1998, Ms. Marram was president and chief executive officer of Tropicana and the Tropicana Beverage Group. From 1988 to 1993, she was president and chief executive officer of the Nabisco Biscuit Company, the largest operating unit of Nabisco, Inc.; from 1987 to 1988, she was president of Nabisco’s grocery division; and from 1970 to 1986, she held a series of marketing positions at Nabisco/Standard Brands, Johnson & Johnson, and Lever Brothers. Ms. Marram is a member of the board of directors of Ford Motor Company and The New York Times Company, as well as several private companies. She previously served on the board of Cadbury plc. She also serves on the boards of Wellesley College, Institute for the Future, New York-Presbyterian Hospital, Lincoln Center Theater, and Families and Work Institute.

Qualifications: Ms. Marram is a former CEO with a strong marketing and consumer-brand background. Through her nonprofit and private company activities, she has a special focus and expertise in wellness and consumer health. Ms. Marram has extensive corporate governance experience through service on other public company boards in a variety of industries.

Board committees: compensation; directors and corporate governance (chair)

|

| | | | |

Douglas R. Oberhelman | | Age 59 | | Director since 2008 |

Chairman and Chief Executive Officer, Caterpillar Inc.

Mr. Oberhelman has been chairman of the board of Caterpillar Inc. since November 2010 and chief executive officer since July 2010. He previously served as vice chairman and chief executive officer-elect of Caterpillar. He joined Caterpillar in 1975 and has held a variety of positions, including senior finance representative based in South America for Caterpillar Americas Co., region finance manager and district manager for the company’s North American commercial division, and managing director and vice general manager for strategic planning at Caterpillar Japan Ltd. Mr. Oberhelman was elected a vice president in 1995, serving as Caterpillar’s chief financial officer from 1995 to November 1998. In 1998, he became vice president with responsibility for the engine products division and he was elected a group president and member of Caterpillar’s executive office in 2002. Mr. Oberhelman serves on the boards of Caterpillar, the National Association of Manufacturers, and the Wetlands America Trust. He previously served on the board of Ameren Corporation. He is a member of the Executive Committee of the Business Roundtable and a member of the Business Council.

Qualifications: Mr. Oberhelman has a strong strategic and operational background as a senior executive (and currently as chairman and CEO) of Caterpillar, a leading manufacturing company with worldwide operations and a special focus on emerging markets. He is an audit committee financial expert as a result of his prior experience as CFO of Caterpillar and as a member and chairman of the audit committee of another U.S. public company.

Board committees: audit; finance

Ralph Alvarez |

Companies, Inc., and Dunkin' Brands Group, Inc. Mr. Alvarez also serves on the President's Council, the School of Business Administration Board of Overseers, and the International Advisory Board of the University of Miami. He was previously a member of the boards of McDonald's Corporation and KeyCorp.

7Qualifications:Through his senior executive positions at Skylark Co., Ltd. and McDonald’s Corporation, as well as with other global restaurant businesses, Mr. Alvarez has extensive experience in consumer marketing, global operations, international business, and strategic planning. His international experience includes a special focus on emerging markets.

Board committees:finance; public policy and compliance; science and technology

Sir Winfried Bischoff,Age 71, Directorsince 2000

Chairman, Lloyds Banking Group plc

Sir Winfried Bischoff has been chairman of the board of Lloyds Banking Group plc since September 2009. He served as chairman of Citigroup Inc. from December 2007 until February 2009 and as interim chief executive officer for a portion of 2007. He served as chairman of Citigroup Europe from 2000 to 2009. From 1995 to 2000, he was chairman of Schroders plc. He joined the Schroder Group in 1966 and held a number of positions

there, including chairman of J. Henry Schroder & Co.

and group chief executive of Schroders plc. He is also a

director of The McGraw-Hill Companies, Inc. He previously served on the boards of Citigroup Inc.,

Prudential plc, Land Securities plc, and Akbank T.A.S.

Qualifications:Sir Winfried Bischoff has a distinguished career in banking and finance, including commercial banking, corporate finance, and investment banking. He has CEO experience both in Europe and the U.S. He is a globalist, with particular expertise in European matters but with extensive experience overseeing worldwide operations. He has broad corporate governance experience from his service on public company boards in the U.S., UK, and other European and Asian countries.

Board committees:directors and corporate governance; finance (chair)

R. David Hoover,Age 67, Director since 2009

Chairman, Ball Corporation

Mr. Hoover is chairman of Ball Corporation, which provides metal packaging for beverages, foods and household products, as well as aerospace and other technologies and services to commercial and governmental customers. Mr. Hoover joined Ball Corporation in 1970 and has held a variety of leadership roles throughout his career, including vice president and treasurer; executive vice president and chief financial officer; vice chairman, president, and chief operating

officer; and chairman, president, and chief executive officer. He is a member of the boards of Ball Corporation, Energizer Holdings, Inc., and Steelcase, Inc. Mr. Hoover is also a director of Boulder Community Hospital, Children's Hospital Colorado, and a member of the Colorado Forum, and is a member and past chair of the board of trustees of DePauw Universityand on the Indiana University Kelley School of Business Dean's Council. Mr. Hoover previously served on the boards of Irwin Financial Corporation and Qwest International, Inc.

Qualifications:Mr. Hoover has extensive CEO experience at Ball Corporation, with a strong record of leadership in operations and strategy. He is an audit committee financial expert as a result of his experience as CEO and CFO of Ball. He also has extensive corporate governance experience through his service on other public company boards.

Board committees: audit; compensation

Franklyn G. Prendergast, M.D., Ph.D.,Age 68, Director since 1995

Edmond and Marion Guggenheim Professor of Biochemistry and Molecular Biology and Professor of Molecular Pharmacology and Experimental Therapeutics, Mayo Medical School; and Director Emeritus, Mayo Clinic Center for Individualized Medicine

Dr. Prendergast is the Edmond and Marion Guggenheim Professor of Biochemistry and Molecular Biology and Professor of Molecular Pharmacology and Experimental Therapeutics at Mayo Medical School and the director emeritus of the Mayo Clinic Center for Individualized Medicine. He is an emeritus member of the Mayo Clinic board of governors and board of trustees and has held severalteaching positions at the Mayo Medical School since 1975.

Qualifications:Dr. Prendergast is a prominent medical clinician, researcher, and academician. He has extensive experience in senior-most administration at Mayo Clinic, a major medical institution, and as director of its renowned cancer center. He has special expertise in two critical areas for Lilly—oncology and personalized medicine. As a medical doctor, he brings an important practicing-physician perspective to the board’s deliberations.

Board committees: public policy and compliance; science and technology

Kathi P. Seifert,Age 63, Director since 1995

Retired Executive Vice President, Kimberly-Clark Corporation

Ms. Seifert served as executive vice president for Kimberly-Clark Corporation, a global consumer products company, until June 2004. She joined

Kimberly-Clark in 1978 and served in several capacities in connection with both the domestic and international consumer-products businesses. Prior to joining Kimberly-Clark, Ms. Seifert held management positions at Procter & Gamble, Beatrice Foods, and Fort Howard Paper Company. She is chairman of Katapult, LLC, a provider of pro bono mentoring and consulting services to other nonprofits. Ms. Seifert serves on the boards of Supervalu Inc.; Revlon Consumer Products Corporation; Lexmark International, Inc.; Appleton Papers Inc.; Fox Cities Performing Arts Center; and the Community Foundation for the Fox Valley Region.

Qualifications:Ms. Seifert is a retired senior executive of Kimberly-Clark. She has strong expertise in consumer marketing and brand management, having led sales and marketing for several worldwide brands, with a special focus on consumer health. She has extensive corporate governance experience through her other board positions.

Board committees:audit; compensation

The following five directors will continue in office until

2013. | | | | |

Ralph Alvarez | | Age 56 | | Director since 2009 |

Retired President and Chief Operating Officer, McDonald’s Corporation

Mr. Alvarez served as president and chief operating officer of McDonald’s Corporation from August 2006 until December 2009. Previously, he served as president of McDonald’s North America, with responsibility for all the McDonald’s restaurants in the U.S. and Canada. Prior to that, he was president of McDonald’s USA. Mr. Alvarez joined McDonald’s in 1994 and held a variety of leadership roles throughout his career, including chief operations officer and president of the central division, both with McDonald’s USA, and president of McDonald’s Mexico. Prior to joining McDonald’s, he held leadership positions at Burger King Corporation and Wendy’s International, Inc. Mr. Alvarez serves on the board of directors of Lowe’s Companies, Inc. He also serves on the President’s Council, the School of Business Administration Board of Overseers, and the International Advisory Board of the University of Miami. He was previously a member of the boards of McDonald’s Corporation and KeyCorp.

Qualifications: Through his senior executive positions at McDonald’s Corporation and other global restaurant businesses, Mr. Alvarez has extensive experience in consumer marketing, global operations, international business, and strategic planning. His international experience includes a special focus on emerging markets.

Board committees: finance; public policy and compliance; science and technology

|

Sir Winfried Bischoff | | Age 70 | | Director since 2000 |

Chairman, Lloyds Banking Group plc

Sir Winfried Bischoff has been chairman of the board of Lloyds Banking Group plc since September 2009. He served as chairman of Citigroup Inc. from December 2007 until February 2009 and as interim chief executive officer for a portion of 2007. He served as chairman of Citigroup Europe from 2000 to 2009. From 1995 to 2000, he was chairman of Schroders plc. He joined the Schroder Group in 1966 and held a number of positions there, including chairman of J. Henry Schroder & Co. and group chief executive of Schroders plc. He is also a director of The McGraw-Hill Companies, Inc. He previously served on the boards of Citigroup Inc., Prudential plc, Land Securities plc, and Akbank T.A.S.

Qualifications: Sir Winfried Bischoff has a distinguished career in banking and finance, including commercial banking, corporate finance, and investment banking. He has CEO experience both in Europe and the U.S. He is a globalist, with particular expertise in European matters but with extensive experience overseeing worldwide operations. He has broad corporate governance experience from his service on public company boards in the U.S., UK, and other European and Asian countries.

Board committees: directors and corporate governance; finance (chair)

|

R. David Hoover | | Age 66 | | Director since 2009 |

Chairman, Ball Corporation

Mr. Hoover is chairman of Ball Corporation. Mr. Hoover joined Ball Corporation in 1970 and has held a variety of leadership roles throughout his career, including vice president and treasurer; executive vice president and chief financial officer; vice chairman, president, and chief operating officer; and chairman, president, and chief executive officer. He is a member of the boards of Ball Corporation and Energizer Holdings, Inc. Mr. Hoover previously served on the board of Irwin Financial Corporation. He is a member and past chair of the board of trustees of DePauw University and on the Indiana University Kelley School of Business Dean’s Council. He is also a director of Boulder Community Hospital and a member of the Colorado Forum.

Qualifications: Mr. Hoover has extensive CEO experience at Ball Corporation, with a strong record of leadership in operations and strategy. He is an audit committee financial expert as a result of his experience as CEO and CFO of Ball. He also has extensive corporate governance experience through his service on other public company boards.

Board committees: audit; compensation

|

2014.

8Michael L. Eskew,Age 63, Director since 2008

Former Chairman and Chief Executive Officer, United Parcel Service, Inc.

Mr. Eskew served as chairman and chief executive officer of United Parcel Service, Inc., from January 2002 until December 2007. He has served on the UPS board of directors since 1998. Mr. Eskew began his UPS career in 1972 as an industrial engineering manager and held various positions of increasing responsibility, including time with UPS's operations in Germany and with UPS Airlines. In 1993, Mr. Eskew was named corporate vice president for industrial engineering. Two years later he became group vice president for engineering. In 1998, he was elected to the UPS board of directors. In 1999, Mr. Eskew was named executive vice president and a year later was given the additional title of vice chairman. He serves as chairman of the board of trustees of The Annie E. Casey Foundation. Mr. Eskew also serves on the boards of 3M Corporation and IBM Corporation.

Qualifications:Mr. Eskew has CEO experience with UPS, where he established a record of success in managing complex worldwide operations, strategic planning, and building a strong consumer-brand focus. He is an audit committee financial expert, based on his CEO experience and his service on other U.S. company audit committees. He has extensive corporate governance experience through his service on the boards of other companies.

Board committees:audit (chair); finance

| | | | |

Franklyn G. Prendergast, M.D., Ph.D. | | Age 66 | | Director since 1995 |

Edmond and Marion Guggenheim Professor of Biochemistry and Molecular Biology and Professor of Molecular Pharmacology and Experimental Therapeutics, Mayo Medical School; and Director, Mayo Clinic Center for Individualized Medicine

Dr. Prendergast is the Edmond and Marion Guggenheim Professor of Biochemistry and Molecular Biology and Professor of Molecular Pharmacology and Experimental Therapeutics at Mayo Medical School and the director of the Mayo Clinic Center for Individualized Medicine. He has held several other teaching positions at the Mayo Medical School since 1975.

Qualifications: Dr. Prendergast is a prominent medical clinician, researcher, and academician. He has extensive experience in senior-most administration at Mayo Clinic, a major medical institution, and as director of its renowned cancer center. He has special expertise in two critical areas for Lilly—oncology and personalized medicine. As a medical doctor, he brings an important practicing-physician perspective to the board’s deliberations.

Board committees: public policy and compliance; science and technology

|

Kathi P. Seifert | | Age 62 | | Director since 1995 |

Retired Executive Vice President, Kimberly-Clark Corporation

Ms. Seifert served as executive vice president for Kimberly-Clark Corporation until June 2004. She joined Kimberly-Clark in 1978 and served in several capacities in connection with both the domestic and international consumer-products businesses. Prior to joining Kimberly-Clark, Ms. Seifert held management positions at Procter & Gamble, Beatrice Foods, and Fort Howard Paper Company. She is chairman of Katapult, LLC. Ms. Seifert serves on the boards of Supervalu Inc.; Revlon Consumer Products Corporation; Lexmark International, Inc.; Appleton Papers Inc.; the U.S. Fund for UNICEF; and the Fox Cities Performing Arts Center.

Qualifications: Ms. Seifert is a retired senior executive of Kimberly-Clark, a global consumer products company. She has strong expertise in consumer marketing and brand management, having led sales and marketing for several worldwide brands, with a special focus on consumer health. She has extensive corporate governance experience through her other board positions.

Board committees: audit; compensation

|

Alfred G. Gilman, M.D., Ph.D., Age 71, Director since 1995

Regental Professor of Pharmacology Emeritus, University of Texas Southwestern Medical Center at Dallas

Dr. Gilman is the regental professor of pharmacology emeritus at the University of Texas Southwestern Medical Center at Dallas. Dr. Gilman was on the faculty of the University of Virginia School of Medicine from1971 to 1981 and was named a professor of pharmacology there in 1977. He previously served as executive vice president for academic affairs and provost of the University of Texas Southwestern Medical Center at Dallas, dean of the University of Texas Southwestern Medical School, and professor of pharmacology at the University of Texas Southwestern Medical Center. He held the Raymond and Ellen Willie Distinguished Chair of Molecular Neuropharmacology, the Nadine and Tom Craddick Distinguished Chair in Medical Science, and the Atticus James Gill, M.D., Chair in Medical Science at the university and was named a regental professor in 1995. Between 2009 and 2012, Dr. Gilman was the chief scientific officer of the Cancer Prevention and Research Institute of Texas. He is a director of Regeneron Pharmaceuticals, Inc. Dr. Gilman was a recipient of the Nobel Prize in Physiology or Medicine in 1994.

Qualifications:Dr. Gilman is a Nobel Prize-winning pharmacologist, researcher, and professor. He has deep expertise in basic science, including mechanisms of drug action, and experience with pharmaceutical discovery research. As the former dean of a major medical school, he brings to the board important perspectives of both the academic and practicing medical communities.

Board committees:public policy and compliance; science and technology (chair)

Karen N. Horn, Ph.D.,Age 69, Director since 1987

Retired President, Private Client Services; Managing Director, Marsh, Inc.

Ms. Horn served as president of private client services and managing director of Marsh, Inc., a global provider of risk and insurance services, from 1999 until her retirement in 2003. Prior to joining Marsh, she was senior managing director and head of international private banking at Bankers Trust Company, chairman and chief executive officer of Bank One, Cleveland, N.A., president of the Federal Reserve Bank of Cleveland, treasurer of Bell Telephone Company of Pennsylvania, and vice president of First National Bank of Boston. Ms. Horn serves as director of T. Rowe Price Mutual Funds, Simon Property Group, Inc., and Norfolk Southern Corporation. She previously served on the boards of Fannie Mae and Georgia-Pacific Corporation. Ms. Horn has been senior managing director of Brock Capital Group, a provider of financial advising and consulting services, since 2004.

Qualifications: Ms. Horn is a former CEO with extensive experience in various segments of the financial industry, including banking and financial services. Through her for-profit and her public-private partnership work, she has significant experience in international economics and finance. Ms. Horn has extensive corporate governance experience through service on other public company boards in a variety of industries.

Board committees:compensation (chair); directors and corporate governance

William G. Kaelin, Jr., M.D.,Age 55, Director since 2012

Professor, Department of Medicine and Associate Director, Basic Science; Dana-Farber/Harvard Cancer Center

Dr. Kaelin, who is currently serving under interim election, joined the board in June 2012 and was referred to the directors and corporate governance committee by an incumbent independent director. Dr. Kaelin is a professor in the Department of Medicine at the

Dana-Farber Cancer Institute and at the Brigham and Women's Hospital, Harvard Medical School, where he began his career as an independent investigator in 1992. He currently serves as associate director, Basic Science, for the Dana-Farber/Harvard Cancer Center. Dr. Kaelin is a prominent member of themedical research community and has received broad recognition forhiswork in oncology research, including the Canada Gairdner International Award and the Lefoulon-Delalande Prize from the Institute of France. Dr. Kaelin is a member of the Institute of Medicine, the National Academy of Sciences, and the Association of American Physicians.

Qualifications:Dr. Kaelin is a prominent medical researcher and academician. He has extensive experience at Harvard Medical School, a major medical institution, as well as special expertise in oncology—a key component of Lilly's business. He also has deep expertise in basic science, including mechanisms of drug action, and experience with pharmaceutical discovery research.

Board Committees:finance; science and technology

John C. Lechleiter, Ph.D.,Age 59, Director since 2005

Chairman, President, and Chief Executive Officer

Dr. Lechleiter has served as president and chief executive officer of Lilly since April 1, 2008. He became the chairman of the board of directors on January 1, 2009. He began work at Lilly in 1979 as a senior organic chemist in process research and development. Prior to joining Lilly, Dr. Lechleiter attended Xavier University (Cincinnati, Ohio), where he earned a bachelor of science degree in chemistry in 1975, and Harvard University, where he earned master's and doctoral degrees in organic chemistry in 1980. Dr. Lechleiter has received honorary doctorates from Marian University

(Indianapolis, Indiana), the University of Indianapolis, and the National University of Ireland. Dr. Lechleiter is a member of the American Chemical Society and Business Roundtable. Dr. Lechleiter serves as chairman of the Pharmaceutical Research and Manufacturers of America (PhRMA), as president of the International Federation of Pharmaceutical Manufacturers & Associations (IFPMA), and on the boards of United Way Worldwide, Xavier University, the Life Sciences Foundation, and the Central Indiana Corporate Partnership. He also serves on the board of Nike, Inc.

Qualifications: Dr. Lechleiter is our chairman, president, and chief executive officer. A Ph.D. chemist,

Dr. Lechleiter has over 30 years of experience with the company in a variety of roles of increasing responsibility in research and development, sales and marketing, and corporate administration. As a result, he has a deep understanding of pharmaceutical research and development, sales and marketing, strategy, and operations. He also has significant corporate governance experience through service on other public company boards.

Board committees:none

The following four directors will continue in office until

2014.2015.

Katherine Baicker, Ph.D., Age 41, Director since 2011

Professor of Health Economics at the Harvard University School of Public Health, Department of Health Policy and Management; and Research Associate at the National Bureau of Economic Research

Dr. Baicker has been a professor of health economics at the Department of Health Policy and Management, School of Public Health, since 2007. From 2005 to 2007, she served as a Senate-confirmed member of the Council of Economic Advisers. From 1998 to 2005,

Dr. Baicker was assistant professor and associate professor ofeconomics at Dartmouth College. In 2001 and 2002 she also served as an economist to the Council ofEconomic Advisers, Executive Office of the President, and in 2003 was a visiting assistant professor at the University of Chicago Harris School of Public Policy.

Dr. Baicker is a commissioner of the Medicare Payment Advisory Commission and serves on the Panel of Health Advisers to the Congressional Budget Office. She is a member of the editorial boards of Health Affairs and the Journal of Health Economics, chair of the board of directors of AcademyHealth, editor of the Forum for Health Economics and Policy, and associate editor of the Journal of Economic Perspectives. She is an elected member of the Institute of Medicine.

Qualifications:Dr. Baicker is a leading researcher in the fields of health economics, public economics, and labor

economics. As a valued advisor to numerous health care-related commissions and committees, her expertise in health care policy and health care delivery is recognized by both academia and government.

Board committees:audit, public policy and compliance

J. Erik Fyrwald, Age 53, Director since 2005

President and Chief Executive Officer, Univar, Inc.

J. Erik Fyrwald joined Univar Inc., a leading distributor of industrial and specialty chemicals and provider of related services, in May 2012 as its president and chief executive officer. In 2008, following a 27-year career at E.I. duPont de Nemours and Company (DuPont), he joined Nalco Company, serving as chairman and chief executive officer until 2011, when Nalco merged with Ecolab Inc. Following the merger, Mr. Fyrwald served as president of Ecolab. From 2003 to 2008, Mr. Fyrwald served as group vice president of the agriculture and nutrition division at DuPont. From 2000 until 2003, he was vice president and general manager of DuPont's nutrition and health business. At DuPont, he held a broad variety of assignments in a number of divisions covering many industries. He has worked in several locations throughout North America and Asia.

Mr. Fyrwald serves as a director of the Society of Chemical Industry, Amsted Industries, and the Chicago Public Education Fund, and he is a trustee of the Field Museum of Chicago.

Qualifications:Mr. Fyrwald has a strong record of operational and strategy leadership in two complex worldwide businesses with a focus on technology and innovation. An engineer by training, he has extensive senior executive experience at DuPont, a multinational chemical company, where he led the agriculture and nutrition division, which used chemical and biotechnology solutions to enhance plant health. He also has experience serving as the CEO of Univar and Nalco.

Board committees:public policy and compliance (chair); science and technology

Ellen R. Marram, Age 66, Director since 2002

President, The Barnegat Group LLC

Ms. Marram began serving as the board's lead director in April 2012. Ms. Marram is the president of The Barnegat Group LLC, a firm that provides business advisory services. She was a managing director at North Castle Partners, LLC from 2000 to 2005 and served as an advisor to the firm from 2006 to 2010. From 1993 to 1998, Ms. Marram was president and chief executive officer of Pepsico's Tropicana and the Tropicana Beverage Group. From 1988 to 1993, she was president and chief executive officer of the Nabisco Biscuit Company, the largest operating unit of Nabisco, Inc.; from 1987 to 1988, she was president of Nabisco's grocery division; and from 1970 to 1986, she held a

series of marketing positions at Nabisco/Standard Brands, Johnson & Johnson, and Lever Brothers.

Ms. Marram is a member of the board of directors of Ford Motor Company and The New York Times Company, as well as several private companies. She previously served on the board of Cadbury plc. She also serves on the boards of Wellesley College, Institute for the Future, New York-Presbyterian Hospital, Lincoln Center Theater, and Families and Work Institute.

Qualifications:Ms. Marram is a former CEO with a strong marketing and consumer-brand background. Through her nonprofit and private company activities, she has a special focus and expertise in wellness and consumer health. Ms. Marram has extensive corporate governance experience through service on other public company boards in a variety of industries.

Board committees:compensation; directors and corporate governance (chair)

Douglas R. Oberhelman,Age 60, Director since 2008

Chairman and Chief Executive Officer, Caterpillar Inc.

Mr. Oberhelman has been chairman of the board of Caterpillar Inc. since November 2010 and chief executive officer since July 2010. He previously served as vice chairman and chief executive officer-elect of Caterpillar. He joined Caterpillar in 1975 and has held a variety of positions, including senior finance representative based in South America for Caterpillar Americas Co., regional finance manager and district

manager for the company's North American commercial division, and managing director and vice general manager for strategic planning at Caterpillar Japan Ltd. Mr. Oberhelman was elected a vice president in 1995, serving as Caterpillar's chief financial officer from 1995 to November 1998. In 1998, he became vice president with responsibility for the engine products division and he was elected a group president and member of Caterpillar's executive office in 2002.

Mr. Oberhelman serves on the boards of Caterpillar, the Wetlands America Trust, and is chairman of the National Association of Manufacturers. He previously served on the board of Ameren Corporation. He is a memberof the Executive Committee of the Business Roundtable and a member of the Business Council.

Qualifications: Mr. Oberhelman has a strong strategic and operational background as a senior executive (and currently as chairman and CEO) of Caterpillar, a leading manufacturing company with worldwide operations and a special focus on emerging markets. He is an audit committee financial expert as a result of his prior experience as CFO of Caterpillar and as a member and chairman of the audit committee of another U.S. public company.

Board committees:audit; finance

Director Compensation

Director compensation is reviewed and approved annually by the board, on the recommendation of the directors and corporate governance committee. Directors who are employees receive no additional compensation for serving on the board.

Cash Compensation

In 2012, the company provided nonemployee directors with an annual retainer of $100,000 (payable in monthly installments). In addition, certain board roles receive additional annual retainers:

$3,000 for audit committee and science and technology committee members

$12,000 for committee chairs ($18,000 for audit committee chair and $15,000 for science and technology committee chair)

$30,000 for the lead director.

Directors are reimbursed for customary and usual travel expenses. Directors may also receive additional retainer amounts for serving on ad hoc committees that may be assembled from time-to-time.

Stock Compensation

Stock compensation for nonemployee directors consists of shares of company stock equaling $145,000, deposited annually in a deferred stock account in the Lilly Directors’ Deferral Plan (as described below), payable after service on the board has ended.

Lilly Directors’ Deferral Plan

This plan allows nonemployee directors to defer receipt of all or part of their cash compensation until after their service on the board has ended. Each director can choose to invest the funds in one or both of two accounts:

Deferred Stock Account. This account allows the director, in effect, to invest his or her deferred cash compensation in company stock. In addition, the annual award of shares to each director noted above (3,083 shares in 2012) is credited to this account on a pre-set annual date. The number of shares credited is calculated by dividing the $145,000 annual compensation figure by the closing stock price on that date. Funds in this account are credited as hypothetical shares of company stock based on the market price of the stock at the time the compensation would otherwise have been earned. Hypothetical dividends are “reinvested” in additional shares based on the market price of the stock on the date dividends are paid. Actual shares are issued or transferred after the director ends his or her service on the board.

Deferred Compensation Account. Funds in this account earn interest each year at a rate of 120 percent of the applicable federal long-term rate, compounded monthly, as established the

preceding December by the U.S. Treasury Department under Section 1274(d) of the Internal Revenue Code of 1986, as amended (the Internal Revenue Code). The aggregate amount of interest that accrued in 2012 for the participating directors was $138,129, at a rate of 3.3 percent. The rate for 2013 is 2.9 percent.

Both accounts may be paid in a lump sum or in annual installments for up to 10 years, beginning the second January following the director’s departure from board service. Amounts in the deferred stock account are paid in shares of company stock.

Director Compensation

In 2012, we provided the following compensation to directors who are not employees:

|

| | | | | | | | |

| Name | Fees Earned

or Paid in Cash ($) | Stock Awards ($) 1 | All Other

Compensation and Payments ($) 2 | Total ($) 3 |

| Mr. Alvarez | $106,000 | | $145,000 | | $0 | | $251,000 | |

| Dr. Baicker | $102,250 | | $145,000 | | $0 | | $247,250 | |

| Sir Winfried Bischoff | $112,000 | | $145,000 | | $0 | | $257,000 | |

| Mr. Eskew | $121,000 | | $145,000 | | $1,500 | | $267,500 | |

| Mr. Fyrwald | $112,000 | | $145,000 | | $35,000 | | $292,000 | |

| Dr. Gilman | $118,000 | | $145,000 | | $14,500 | | $277,500 | |

| Mr. Hoover | $106,000 | | $145,000 | | $30,000 | | $281,000 | |

| Ms. Horn | $119,500 | | $145,000 | | $5,250 | | $269,750 | |

| Dr. Kaelin | $60,083 | | $84,583 | | $11,200 | | $155,867 | |

| Ms. Marram | $134,500 | | $145,000 | | $30,000 | | $309,500 | |

| Mr. Oberhelman | $106,000 | | $145,000 | | $33,750 | | $284,750 | |

| Dr. Prendergast | $103,000 | | $145,000 | | $0 | | $248,000 | |

| Ms. Seifert | $103,000 | | $145,000 | | $13,650 | | $261,650 | |

| | | | |

Michael L. Eskew1

| | Age 62 | | Director since 2008 |

Former ChairmanEach nonemployee director received an award of stock valued at $145,000 (3,083 shares), except Dr. Kaelin, who received shares proportionately for a partial year of service. This stock award and Chief Executive Officer, United Parcel Service, Inc.

Mr. Eskew served as chairman and chief executive officer of United Parcel Service, Inc., from January 2002all prior stock awards are fully vested in that they are not subject to forfeiture; however, the shares are not issued until December 2007. He continues to serve on the UPS board of directors. Mr. Eskew begandirector ends his UPS career in 1972 as an industrial engineering manager and held various positions of increasing responsibility, including time with UPS’s operations in Germany and with UPS Airlines. In 1993, Mr. Eskew was named corporate vice president for industrial engineering. Two years later he became group vice president for engineering. In 1998, he was elected to the UPS board of directors. In 1999, Mr. Eskew was named executive vice president and a year later was given the additional title of vice chairman. He serves as chairman of the board of trustees of The Annie E. Casey Foundation. Mr. Eskew also serves on the boards of 3M Corporation and IBM Corporation.

Qualifications: Mr. Eskew has CEO experience with UPS, where he established a record of success in managing complex worldwide operations, strategic planning, and building a strong consumer-brand focus. He is an audit committee financial expert, based on his CEO experience and his service on other U.S. company audit committees. He has extensive corporate governance experience through hisor her service on the boardsboard, as described above under “Lilly Directors’ Deferral Plan.” The column shows the grant date fair value for each director’s stock award. Aggregate outstanding stock awards are shown in the “Common Stock Ownership by Directors and Executive Officers” table in the “Directors’ Deferral Plan Shares” column. Aggregate outstanding stock options as of other companies.

Board committees: audit (chair); compensation

December 31, 2012 are shown in the table below. Nonemployee directors received no stock options in 2012. The company discontinued granting stock options to nonemployee directors in 2005. A discussion of methodology used in calculating the award values can be found above under the heading "Lilly Directors' Deferral Plan." |

9

|

| | |

| Name | Outstanding Stock Options (Exercisable) | Weighted Average Exercise Price |

| Sir Winfried Bischoff | 5,600 | $65.48 |

| Dr. Gilman | 5,600 | $65.48 |

| Ms. Horn | 5,600 | $65.48 |

| Ms. Marram | 5,600 | $65.48 |

| Dr. Prendergast | 5,600 | $65.48 |

| Ms. Seifert | 5,600 | $65.48 |

| | | | |

Alfred G. Gilman, M.D., Ph.D.2

| | Age 70 | | Director since 1995 |

Chief Scientific Officer, Cancer PreventionThis column consists of amounts donated by the Eli Lilly and Research InstituteCompany Foundation, Inc. under its matching gift program, which is generally available to U.S. employees as well as the outside directors. Under this program, the foundation matched 100 percent of TexasDr. Gilman ischaritable donations over $25 made to eligible charities, up to a maximum of $30,000 per year for each individual. The foundation matched these donations via payments made directly to the chief scientific officer of the Cancer Preventionrecipient charity.The amounts for Mr. Fyrwald and Research Institute of Texas and regental professor of pharmacology emeritusMr. Oberhelman include matching contributions for donations made at the Universityend of Texas Southwestern Medical Center at Dallas. Dr. Gilman2011 (Mr. Fyrwald – $15,000; Mr. Oberhelman – $5,000), for which the matching contribution was on the faculty of the University of Virginia School of Medicine from 1971 to 1981 and was named a professor of pharmacology there in 1977. He previously served as executive vice president for academic affairs and provost of the University of Texas Southwestern Medical Center at Dallas, dean of the University of Texas Southwestern Medical School, and professor of pharmacology at the University of Texas Southwestern Medical Center. He held the Raymond and Ellen Willie Distinguished Chair of Molecular Neuropharmacology; the Nadine and Tom Craddick Distinguished Chair in Medical Science; and the Atticus James Gill, M.D., Chair in Medical Science at the university and was named a regental professor in 1995. He is a director of Regeneron Pharmaceuticals, Inc. Dr. Gilman was a recipient of the Nobel Prize in Physiology or Medicine in 1994.

Qualifications: Dr. Gilman is a Nobel Prize-winning pharmacologist, researcher, and professor. He has deep expertise in basic science, including mechanisms of drug action, and experience with pharmaceutical discovery research. As the former dean of a major medical school, he brings to the board important perspectives of both the academic and practicing medical communities.not paid until 2012.

Board committees: public policy and compliance; science and technology (chair)

|

| | | | |

Karen N. Horn, Ph.D.3

| | Age 68 | | Director since 1987 |

Retired President, Private Client Services, and Managing Director, Marsh, Inc.

Ms. Horn will serve as the board’s lead director until April 2012. She served as president of private client services and managing director of Marsh, Inc. from 1999 until her retirement in 2003. Prior to joining Marsh, she was senior managing director and head of international private banking at Bankers Trust Company; chairman and chief executive officer of Bank One, Cleveland, N.A.; president of the Federal Reserve Bank of Cleveland; treasurer of Bell Telephone Company of Pennsylvania; and vice president of First National Bank of Boston. Ms. Horn serves as director of T. Rowe Price Mutual Funds; Simon Property Group, Inc.; and Norfolk Southern Corporation and vice chairman of the U.S. Russia Foundation. She previously served on the board of Fannie Mae and Georgia-Pacific Corporation. Ms. Horn has been senior managing director of Brock Capital Group since 2004.

Qualifications: Ms. Horn is a former CEO with extensive experience in various segments of the financial industry, including banking and financial services. Through her for-profit and her public-private partnership work, she has significant experience in international economics and finance. Ms. Horn has extensive corporate governance experience through service on other public company boardsDirectors do not participate in a variety of industries.

Board committees: compensation (chair); directors and corporate governance

|

| | | | |

John C. Lechleiter, Ph.D. | | Age 58 | | Director since 2005 |

Chairman, President, and Chief Executive Officer

Dr. Lechleiter is chairman, president, and chief executive officer of Eli Lilly and Company. He served as president and chief operating officer from 2005 to 2008. He joined Lilly in 1979 as a senior organic chemist and has held management positions in England and the U.S. He was named vice president of pharmaceutical product development in 1993 and vice president of regulatory affairs in 1994. In 1996, he was named vice president for development and regulatory affairs. Dr. Lechleiter became senior vice president of pharmaceutical products in 1998 and executive vice president for pharmaceutical products and corporate development in 2001. He was named executive vice president for pharmaceutical operations in 2004. He is a member of the American Chemical Society and the Business Roundtable. Dr. Lechleiter serves as chairman-elect of Pharmaceutical Research and Manufacturers of America (PhRMA), and on the boards of United Way Worldwide, Xavier University (Cincinnati, Ohio), Life Sciences Foundation, and the Central Indiana Corporate Partnership. He also serves on the board of Nike, Inc.

Qualifications: Dr. Lechleiter is our chairman, president, and chief executive officer. Under our corporate governance guidelines, the CEO is expected to serve on the board of directors. Dr. Lechleiter, a Ph.D. chemist, has over 30 years of experience with the company in a variety of roles of increasing responsibility in research and development, sales and marketing, and corporate administration. As a result, he has a deep understanding of pharmaceutical research and development, sales and marketing, strategy, and operations. He also has significant corporate governance experience through service on other public company boards.

Board committees: none

pension plan or non-equity incentive plan. |

Highlights of the Company’s Corporate Governance Guidelines

The following summary provides highlights of the company’s guidelines established by the board of directors. A complete copy of the

corporate governance guidelines is available online at

http://investor.lilly.com/governance.cfm or

in paper form upon request to the company’s corporate secretary.

The directors are elected by the shareholders to oversee the actions and results of the company’s management. Their responsibilities include:

providing general oversight of the business

approving corporate strategy

approving major management initiatives

providing oversight of legal and ethical conduct

overseeing the company’s management of significant business risks

selecting, compensating, and evaluating directors

evaluating board processes and performance

selecting, compensating, evaluating, and, when necessary, replacing the chief executive officer, and compensating other senior executives

ensuring that aan effective succession plan is in place for all senior executives.

II. Composition of the Board

Mix of Independent Directors and Officer-Directors

There should always be a substantial majority (75 percent or more) of independent directors. The chief executive officer should be a board member. Other officers may, from time to time, be board members, but no officer other than the chief executive officer should expect to be elected to the board by virtue of his or her position in the company.

Selection of Director Candidates

The board selects candidates for board membership and establishes the criteria to be used in identifying potential candidates. The board delegates the screening process to the directors and corporate governance committee.

Independence Determinations

The board annually determines the independence of directors based on a review by the directors and

corporate governance committee. No director is considered independent unless the board has determined that he or she has no material relationship with the company, either directly or as a partner, significant shareholder, or officer of an organization that has a material relationship with the company. Material

relationships can include commercial, industrial,banking, consulting, legal, accounting, charitable, and familial relationships, among others. To evaluate the

materiality of any such relationship, the board has adopted categorical independence standards consistent with the New York Stock Exchange (NYSE) listing standards, except that the “look-back period” for determining whether a director’s prior

relationshiprelationship(s) with the company impairs independence is extended from three to four years.

Specifically, a director is not considered independent if (i) the director or an immediate family member is a current partner of the company’s independent auditor (currently Ernst & Young LLP); (ii) the director is a current employee of such firm; (iii) the director has an immediate family member who is a current employee of such firm and who participates in the firm’s audit, assurance, or tax compliance (but not tax planning) practice; or (iv) the director or an immediate family member was within the last four years (but is no longer) a partner or employee of such firm and personally worked on our audit within that time.

In addition, a director is not considered independent if any of the following relationships existed within the previous four years:

aA director who is an employee of the company, or whose immediate family member is an executive officer of the company. Temporary service by an independent director as interim chairman or chief executive officer will not disqualify the director from being independent following completion of that service.

aA director who receives any direct compensation from the company other than the director’s normal director compensation, or whose immediate family member receives more than $120,000 per year in direct compensation from the company other than for service as a nonexecutive employee.

11

aA director who is employed (or whose immediate family member is currently employed as an executive officer) by another company where any Lilly executive officer serves on the compensation committee of that company’s board.

aA director who is currently employed by, who is a 10 percent shareholder of, or whose immediate family member is currently employed as an executive officer of a company that makes payments to or receives payments from Lilly for property or services that exceed the greater of $1 million or 2 percent of that company’s consolidated gross revenue in a single fiscal year.

aA director who is a current executive officer of a nonprofit organization that receives grants or contributions from the company exceeding the greater of $1 million or 2 percent of that organization’s consolidated gross revenue in a single fiscal year.

Members of board committees must meet all applicable independence tests of the NYSE, Securities and Exchange Commission (SEC), and Internal Revenue Service (IRS).

The directors and corporate governance committee determined that all 13 nonemployee directors listed below are independent, and that the members of each committee also meet the independence standards referenced above. The directors and corporate governance committee recommended this conclusion to the board and explained the basis for its decision, and this conclusion was adopted by the board. TheThis committee and the board determined that none of the 13 directors has had during the last four years (i) any of the relationships listed above or (ii) any other material relationship with the company that would compromise

his or her independence. In reaching thisconclusion, the directors and corporate governance committee reviewed directors’ responses to a questionnaire asking about their relationships with the company and other potential conflicts of interest, as well as information provided by management related to transactions, relationships, or arrangements between the company and the directors or parties related to the directors. The table below includes a description of categories or types of transactions, relationships, or arrangements considered by the board in reaching its determinations. All of these transactions were entered into at arm’s length in the normal course of business and, to the extent they are commercial relationships, have standard commercial terms. None of these transactions exceeded the thresholds described above or otherwise compromises the independence of the named directors.

| | | | | |

| | |

| Name | Independent | | | Independent | | | | Transactions/Relationships/Arrangements |

Mr. Alvarez | | | | Yes | | | | None |

Dr. Baicker | | | | Yes | | | | Payments to Harvard University totallingtotaling approximately $2.3$3.1 million (less than 0.1 percent of Harvard’s consolidated grossHarvard's total revenue), primarily for medical research |

Sir Winfried Bischoff | | | | Yes | | | | None |

Mr. Eskew | | | | Yes | | | | None |

Dr. Feldstein

| | | Mr. Fyrwald | Yes | | | | Payments to Harvard University totalling approximately $2.3 million (less than 0.1 percent of Harvard’s consolidated gross revenue), primarily for medical research |

Mr. Fyrwald

| | | | Yes | | | | Purchases of products and services from Ecolab totallingtotaling approximately $1.0$0.7 million (less than 0.1 percent of Ecolab’s consolidated grossEcolab's total revenue)

Purchases of products from Univar, Inc. totaling $1.9 million (less than 0.1 percent of Univar's total revenue) |

Dr. Gilman | | | | Yes | | | | None |

Mr. Hoover | | | | Yes | | | | None |

Ms. Horn | | | | Yes | | | | None |

Ms. Marram

| | | Dr. Kaelin | Yes | Payments to Harvard University totaling approximately $3.1 million (less than 0.1 percent of Harvard's total revenue), primarily for medical research

Payments to Brigham and Women's Hospital totaling approximately $0.7 million (less than 0.1 percent of Brigham's total revenue), primarily for medical research

Payments to Dana-Farber Cancer Institute totaling approximately $1.7 million (less than 0.1 percent of Dana-Farber's total revenue), primarily for medical research |

| Ms. Marram | | Yes | None |

Mr. Oberhelman | | | | Yes | | | | None |

Dr. Prendergast | | | | Yes | | | | Payments to the Mayo Clinic and the Mayo Foundation totallingtotaling approximately $2.2$4.4 million (less than 0.1 percent of Mayo’s consolidated grossMayo's total revenue), primarily for medical research |

Ms. Seifert | | | | Yes | | | | None |

Subject to the company’s charter documents, the following are the board’s expectations for director tenure:

A company officer-director, including the chief executive officer, will resign from the board at the time he or she retires or otherwise ceases to be an active employee of the company.

Nonemployee directors will retire from the board not later than the annual meeting of shareholders that follows their seventy-second birthday.

Directors may stand for reelection even though the board’s retirement policy would prevent them from completing a full three-year term.

A nonemployee director who retires or changes

principal job responsibilities will offer to resign from the board. The directors and corporate governance committee will assess the situation and recommend to the board whether to accept the resignation.

The directors and corporate governance committee, with input from all board members, also considers the contributions of individual directors at least every three years when considering whether to recommend nominating the director to a new three-year term.

12

Other Board Service

Effective November 1, 2009, no

No new director may serve on more than three other public company boards, and no incumbent director may

accept new positions on public company boards that would result in service on more than three other public company boards. The directors and corporate governance committee or the chair of that committee may approve exceptions to this limit upon a determination that such additional service will not impair the director’s effectiveness on the board.

In an uncontested election,

directors are elected by a majority of the votes cast. Under the bylaws, any